Make an Enterprise Zone Tax-Deductible Gift

UCHealth Memorial Foundation is one of several Enterprise Zones designated by the State of Colorado to encourage economic growth. Colorado taxpayers who make qualifying gifts to UCHealth Memorial Foundation* are eligible for a generous state income tax credit of up to 25% if giving an outright gift of cash or tax credit of 12.5% for gifts of appreciated stock.

State Income Tax Decreases

Your Gift Goes Further

It’s an EZ Gift and Tax Win!

The Enterprise Zone tax credit allows you to support the UCHealth Memorial Foundation while lowering your Colorado state income tax. In addition to the federal and state charitable deductions you may already receive, this program enables you to significantly enhance the value of your gift – almost doubling your eligible contribution – without increasing the net cost to you. Your generosity can have an even greater impact!

You can nearly double the size of your gift – and the impact of your generosity – without increasing the net cost to you.

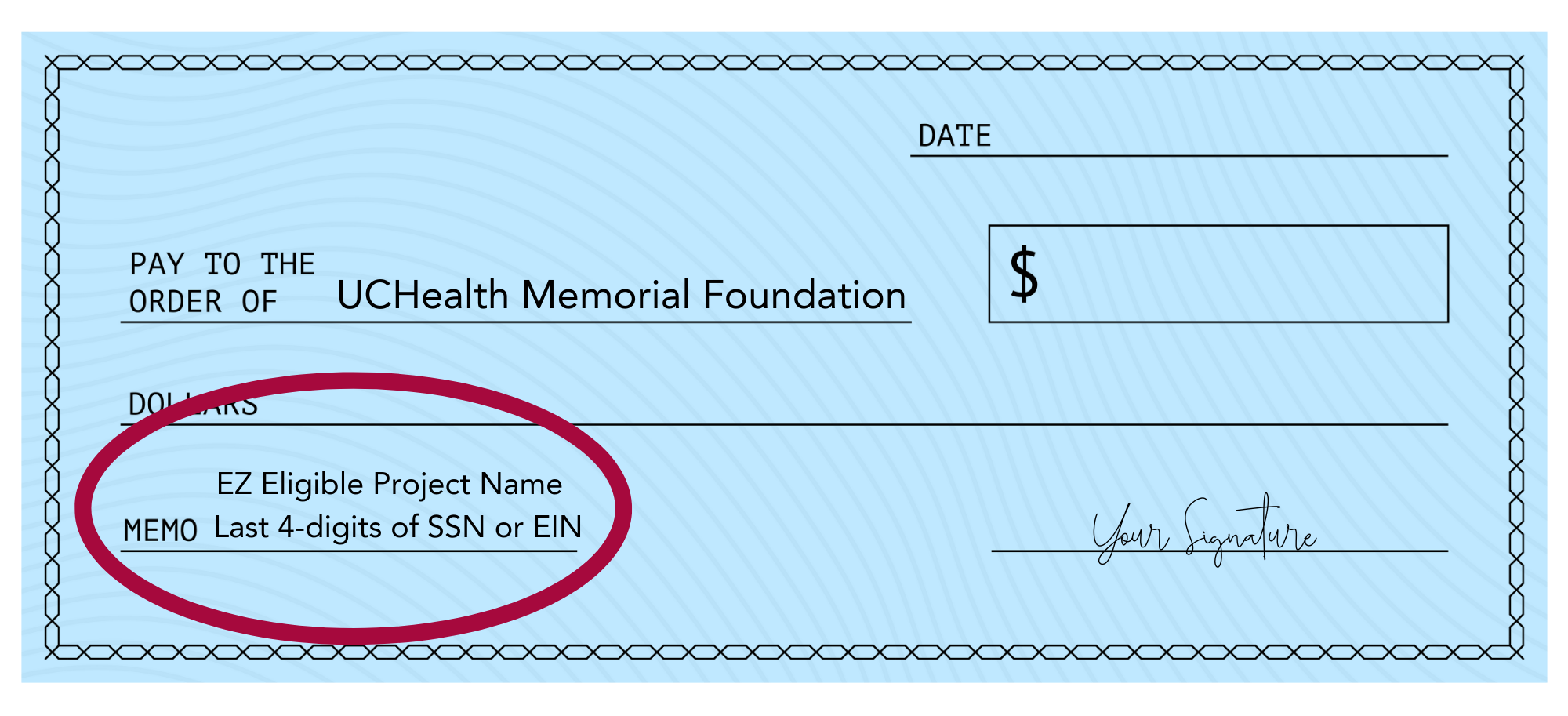

To take advantage of this program, contribute through an online gift or make your check payable to “UCHealth Memorial Foundation” with “EZ” and the last 4 digits of your SSN or EIN number in the memo line, See the example below:

Mail your contribution to UCHealth Memorial Foundation’s address:

P.O. Box 9530

Colorado Springs, CO 80932